Investing Starter Kit

I strongly believe that access to financial knowledge should be universal. Personal finance is often viewed as a scary or taboo topic, but it really doesn't have to be.

All of the knowledge is out there, and everyone deserves to be wealthy.

Here are some starter resources to get you started on your journey. I'm always happy to make time to chat with you and help you discover your goals - all I ask is that you pay it forward and share this knowledge with others who may need it.

Remember: you should not have to pay to get this knowledge. There are no "secrets" that a special guru can teach you for the "low price of 19.99/mo". All of this knowledge is free and accessible to anyone who looks.

Investing is the key to wealth. At first, you work for money. Later, your money should be working for you. The power of compound interest is unimaginable.

Examples of Compound Interest

Scenario 1:

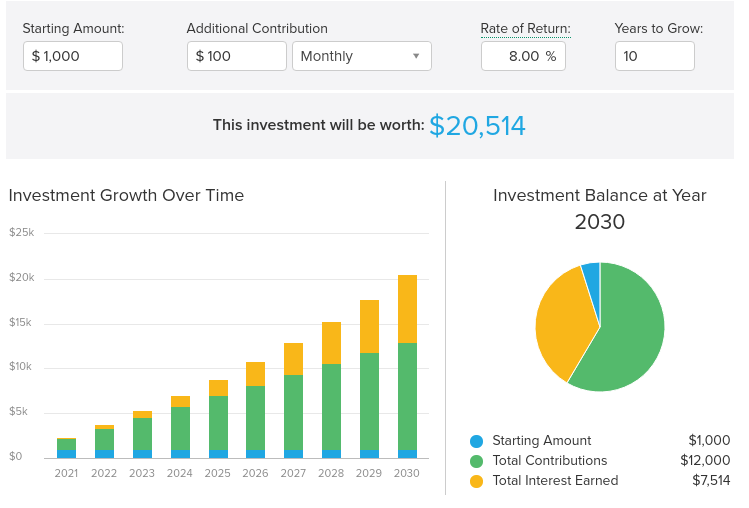

If you start with $1,000 and invest $100 every month, over 10 years your portfolio can grow to $20,514 (assuming an 8% return). [calculator]

Scenario 2:

If you have more resources that you can put towards your portfolio, the growth is even crazier. Let's pretend you have $20,000 to start with and can invest $400 every week. You will end up with $362,768 in 10 years. [calculator]

Notice how during the later years, your interest actually starts catching up to your contributions. This is the power of compound interest. Your money starts to work for you faster and faster, all while you sleep.

Market Investing: Stocks, Bonds, and Funds

So, where do you start? First, you must learn. Read up on the basics, go through the guides and try out the simulators. Once you are comfortable, start with a small amount of money that you won't lose sleep over, and just start practicing. It's much better to lose $1,000 in your 30's compared to losing $100,000 in your 50's. Start now and learn on small portfolios, so that later you can make great decisions.

Basic Guides (start here)

- https://www.investopedia.com/articles/basics/11/3-s-simple-investing.asp - Simple guide that gently introduces you to various common terms and concepts. There are more links in the sidebar.

- https://www.nerdwallet.com/article/investing/stocks-vs-bonds - Stocks vs Bonds guide.

- https://www.nerdwallet.com/article/investing/what-is-an-etf - Guide for ETF's

- https://www.fool.com/investing/how-to-invest/ - Starter guide that covers the basics.

- https://www.millennial-revolution.com/investworkshop/ - this is an excellent starter guide. It explains the basics of stocks, bonds, ETF's, portfolios, and more.

Practice

Once you are ready to play, you can use these two tools as simulators with "paper money" to get a sense of how things work.

- Investopedia Simulator

- ThinkOrSwim - you can set up an account and practice using a more advanced interface. MAKE SURE that you are using your paper funds and not real money.

Tools for Analysis

- Backtest Portfolio Asset Class Allocation - as you start to form an opinion about what you would like your portfolio to look like, you can use this tool to see how you WOULD have performed. I typically set it to start in 2000 or 2009, since the world has changed a TON since 1980.

- Personal Capital - Provides an excellent visualization and overview of what your accounts look like. I'm a big fan of the "Net Worth" chart, since it shows how you are doing overall. There are also some planning and simulation capabilities in there.

Books:

- One Up on Wall Street - I've heard really good things about it. Haven't read it yet, but it's come up enough that it's a good candidate for you to check out.

- The Little Book of Common Sense Investing

- Anti Recommendation: I have read Rich Dad, Poor Dad several times, but I didn't actually see tons of useful insights in there. It's considered a classic, but it's honestly mostly just a memoir of a real estate mogul who managed to achieve success. The biggest takeaway is: have your money work for you, and optimize for passive income growth. Don't trade time for money directly. Make your resources (money or your business) work for you.

Broker Choice

Once you are ready to start investing for real, you will need to pick a broker.

Common choices are:

I have strong opinions about which ones to use and which ones to avoid, but in the interest of fairness I will simply list them all and let you decide for yourself. Key things to look out for are no commission fees (you shouldn't have to pay to buy or sell stocks) and a good selection of ETF and mutual funds.

You can see comparisons on https://www.nerdwallet.com/best/investing/online-brokers-for-stock-trading and other similar sites.

General Financial News and Analysis

None of these sites are required or part of the basic toolkit I list above. If you want to dive deeper into this space, these can be a good starting point to get the lay of the land.

- https://seekingalpha.com/ - This is an interesting site. It's more focused on individual stock picks, and they will try to up-sell you to pay for their premium analysis. I don't think it's worth it. However, this can be an interesting site to peruse every few months to see what the latest trends are.

- https://www.ft.com/ - Good overview of general market trends and situations.

- https://www.mckinsey.com/featured-insights - High level overviews of the business world and long term trends. Not related to specifically market news.

- https://www.fool.com/ - Similar to Seeking Alpha. General Ticker news.

Real Estate Investing

This is a topic I am still quite new to, but I have already found a number of highly useful guides and resources.

- BiggerPockets - This is the best site out there for comprehensive advice. They have an excellent Ultimate Beginner's Guide that covers everything you need to know.

- https://www.madfientist.com/tax-benefits-of-real-estate-investing/

- How to analyze a real estate market in 60 minutes - Neal Bawa - worth watching in its' entirety. Neal runs MultifamilyU and has a course on Udemy with the same material.

Final Comments

A few words of advice:

- Make sure you understand all the basic terms: stocks, bonds, funds, portfolio allocation, backtesting, SP500 index, bear market, bull market.

- AVOID OPTIONS AT ALL COSTS. These are very powerful tools which can make you a TON of money if you know what you are doing. However, it is my strong recommendation to avoid options (calls, puts, straddles, etc) until you have spent at least 2-3 years investing in basic financial instruments such as ETF's and mutual funds.

- Take everything you read online with a grain of salt. There are many people who claim they are "experts" and can beat the market. Don't believe them. Ask to see their historical returns. To the best of my knowledge, there is no one that has consistently outperformed the SP500 or general stock market over the long run. Anyone can outperform the index by sheer dumb luck over a short enough time horizon. It's consistency that matters.

- Beware of advisory fees or high expense ratios. Some of the ETF's or mutual funds you may find (such as blackrock, etc) are professionally managed and charge up to 1% management fees. That eats into your profits, and you pay the fee no matter if you made money or lost money. Vanguard funds charge 0.04%, which is a much better deal.

- Understand you HAVE NOT LOST MONEY until you sell. Your portfolio can be down 50%, but it's only when you sell your assets at a loss do you lock in your losses. Do not panic - you might have lost tons of value on paper, but it's not the same as getting your bank account robbed.

- Understand what you are investing in. There are tons of new financial instruments coming out, proposing investments in art, wine, crypto, and more. Read the fine print on these and seek to understand what is it exactly that you are investing in, and what are the hidden fees.

- Not all stocks are listed on the Nasdaq or New York stock exchange. There are markets all over the world: https://craft.co/nasdaq/competitors . Don't be surprised if you can't find a particular company.

- If you have the funds and interest, I wholeheartedly encourage you to set aside some small percentage of your portfolio for gambling with individual stocks. I find that it's a great way to scratch that itch of picking stocks. After a few years, you can compare your returns to the standard ETF portfolio you probably set up and draw your own conclusions about whether the time and effort you put into day trading is worth it.

Go forth and prosper!